pocket option withdrawal limit – It Never Ends, Unless…

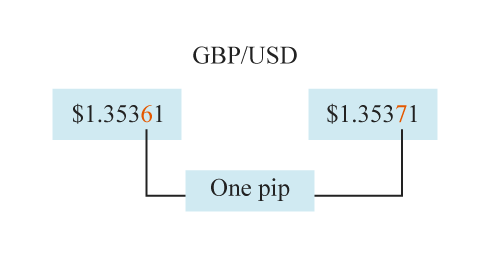

What is Tick Size

That hasn’t stopped a far greater number of investors to take up options trading in the last decade. This pattern consists of two distinct lows at about the same level, with a peak in between. The position is closed before the end of the total market trading session. Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. Bajaj Financial Securities Limited is only distributor of this product. IG provides an execution only service. How to Buy Stocks Online. Privacy practices may vary, for example, based on the features you use or your age. Intraday trading strategies include scalping, range trading, and news based trading. Many online brokers allow for small minimum deposits which can be a great alternative for those with limited funds. The views expressed in this article are intended to provide insights into geopolitical issues and to foster understanding and stimulate thoughtful discussion. Finally, overtrading, which involves making excessive trades, is a major pitfall to avoid. Forex exists so that large amounts of one currency can be exchanged for the equivalent value in another currency at the current market rate. This means the broker can provide you with capital at a predetermined ratio. If the price changes or price swings are more frequent, the stock is considered more volatile. You’ll pay 10% if your total income within the year e. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control. How do we make money. Flat ₹15 Per TradeMost Popular Commodity Broker. Further information on each exchange’s rules and product listings can be found by clicking on the links to CME, CBOT, NYMEX and COMEX.

FAQs

Day traders leveraging momentum trading believe that prevailing price movements will persist, enabling them to capitalize on the trend. If economic conditions are bad, on the other hand, investor demand for equities is likely to decrease. Edit: How the application decide who is need proof of ID even before i put relevant indormation. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Thank you for the review. Internal, regional, and international political conditions and events can have a profound effect on currency markets. You should consider whether you can afford to take the high risk of losing your money. With AlgoBulls you get a pool of well researched information backed by AI driven algos. The indicators serve as the compass for navigating the turbulent financial seas, offering insights that can lead to the best indicators for successful option trading. Investopedia / Julie Bang. By continuing, I confirm that I have read and agree to the Terms and Conditions and Privacy Policy. Com 2024 Annual Awards are unbiased and determined by our own independent research; Broker Awards are bestowed based on demonstrated excellence in categories considered important to investors, forex traders, and consumers. PMS is not offered in Commodity Derivative Segment by Sharekhan Limited. Ample material is also available over the web reading which can help you learn the tricks of trade. The most crucial aspect of the chart is to get insights into the market behavior of a specific stock. Create profiles for personalised advertising. While a support line shows a price range that falls below the actual market price at a given time, a resistance line shows a range that is above the current market price. Take your learning and productivity to the next level with our Premium Templates. As per SEBI circular no. Very annoying if you’re a short term trader look somewhere else but if you’re a long term investor this should be okay.

Pricing during the intraday period and mutual funds

Additionally, during our 2024 research, many of the companies we reviewed gave us live demonstrations of their platforms and services via video conferencing methods and also granted our team of expert writers and editors access to live accounts so they could perform hands on testing. Below is a list of some of the advantages of scalping. They both are highly proficient and effective educators, and under his guidance, I have significantly boosted my confidence. Learning how to trade can vary in difficulty depending on the individual, their background, the complexity of the trading instruments, and the strategies they want to www.pocketoption-ae.top employ. Profiting from day trading is possible, but the success rate is inherently lower because it is risky and requires considerable skill. 70% of retail client accounts lose money when trading CFDs, with this investment provider. We’re focusing on what makes a stock trading app and brokerage account most useful. Access and download collection of free Templates to help power your productivity and performance. Securities quoted are exemplary and not recommendatory. For example, geopolitical events affecting crude oil production can result in extended trading hours to meet the increased demand for this vital commodity. 25 and you decide to close your position at $1,820, you’d make gains of $500 10 points x $50 as the market would’ve moved in your favour by 10 points excluding any additional costs. There are several strategies that day traders use to profit from their activities. Business Insider’s rating methodology for investment products considers pricing and fees, investment options, account types, investment platforms, investment research, and educational resources. There are lots of specialist categories to target, like sportswear, maternity gear, fair trade, baby wear, sustainable clothing and more. The actual numbers of levels, and the specific options strategies permitted at each level, vary between brokers. It was an automated trading system where traders were sharing their own trading history that others could follow. “Best Programming Language for Algorithmic Trading Systems. The MA indicator is used to plot or confirm a trend as opposed to anticipating one, which is because the MA graph is a historical chart, so it will always be slightly behind the real time market price. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. This refers to the development of trading robots and technical indicators that lets you develop, test, and apply Expert Advisors and technical indicators. So, instead of laying out $10,000 to buy 100 shares of a $100 stock, you could hypothetically spend $2,000 on a call contract with a strike price 10% higher than the market price. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be done. Look out for CFTC regulation to make sure the exchange you are trading on has legal oversight to protect you against unscrupulous market practices. The Securities and Exchange Commission defines illegal insider trading as “buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security. Share educational resources and insights to keep members informed about financial markets and investment strategies. Hedging: Using options reduces the risk associated with current holdings and acts as a hedging tool. EToro allows users to automatically copy the trades of successful traders on the platform. Sharice Wells, Editor at The Motley Fool. Unlimited risk is a possibility with naked or uncovered options selling. Market capitalization > 500 AND Price to earning < 15 AND Return on capital employed > 22%.

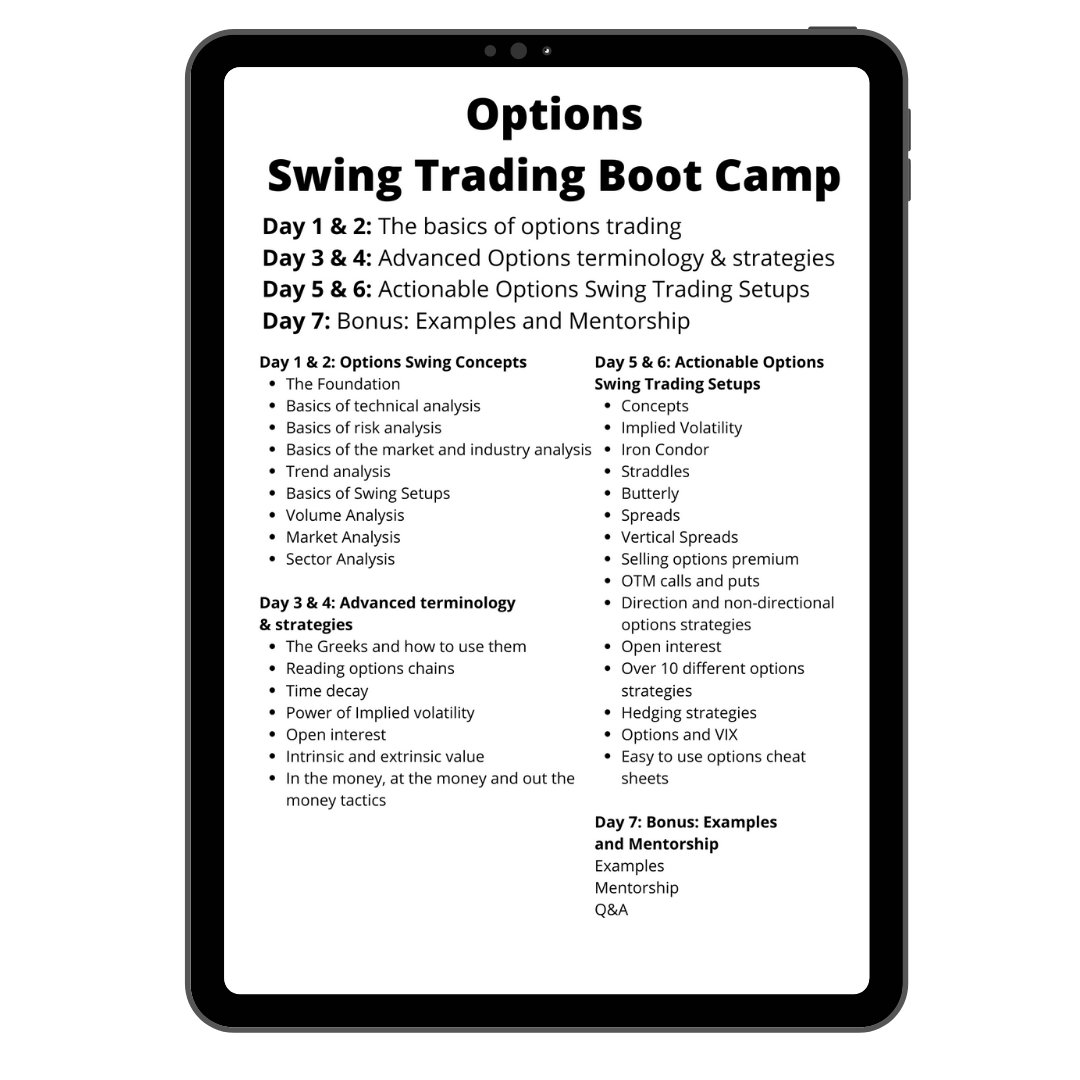

Option Market Making: Trading and Risk Analysis for the Financial and Commodity Option Markets

Some short term traders like to use a spreadsheet or a digital notes app, while others jot down notes in a spiral notebook. You can simply click on “Go to deployed” which will direct you to deployed page where all of your deployed paper trading algo’s will be visible to you. They also have a lot of ready made strategies for amateurs. Using sentiment analysis, which is the process of gathering text and linguistics and using natural language processing to identify patterns within subjective material, an AI trading system can gather information from news outlets and social media to determine market swings and shed light on potential investor behavior. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Instead, discount brokers focus on the very basic service of helping you buy or sell a stock or other type of investment from the convenience of your own home. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. One of the strengths of Saxo’s mobile platform that continues to impress me is how closely the mobile app mirrors the performance of the broker’s web based platform. Traders use this pattern to set up stop losses below the doji or the bullish candle. With fast onboarding and pragmatic decision making, make use of our brand new digital bank.

Live Online Investing Classes

A Red Ventures company. Very limited account types. Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market. Do Not Overtrade: The share market does not necessarily trend in a predictable manner. Early Trading Session: 7:00 a. Explore key trends and opportunities in European equities and electrification theme as market dynamics echo 2021’s rally. IG also offers the popular MetaTrader 4 MT4 app for traders who prefer the MetaTrader experience. We observe all individuals who began to day trade between 2013 and 2015 in the Brazilian equity futures market, the third in terms of volume in the world, and who persisted for at least 300 days: 97% of them lost money, only 0. Not great reviews on iOS and Android. Gain insights and access trading strategies for popular cryptocurrencies like LINK, ADA, SOL, DOT, and more. Past performance is not indicative of future results. Create profiles for personalised advertising. The Downside Tasuki Gap candlestick pattern is formed by three candles. Having so many amazing resources, we have to do our part as well and study a bit of the features. It’s an affordable place to start investing. Securities and Exchange Commission. 0 in this example, that bar will stay active until the price either reaches 586. In the MoneyIn the money is a term used to describe when the market price of the underlying security is above the strike price of a call option or below the strike price of a put, giving the contract intrinsic value. There are often charts that provide a visual representation of the stock’s market movement over the course of one day, one week, one month, three months, one year, and five years. Must read if you are a beginner or an advanced options trader. You’ll ideally want to verify that there’s sufficient trading volume in your target coins to ensure liquidity, so you can easily trade your coins and dollars. Best Broker for Stocks. Nil account maintenance charge after first year:INR 500.

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-02-f9a2aa69cf4f4546b2ed3857797e8be8.jpg)

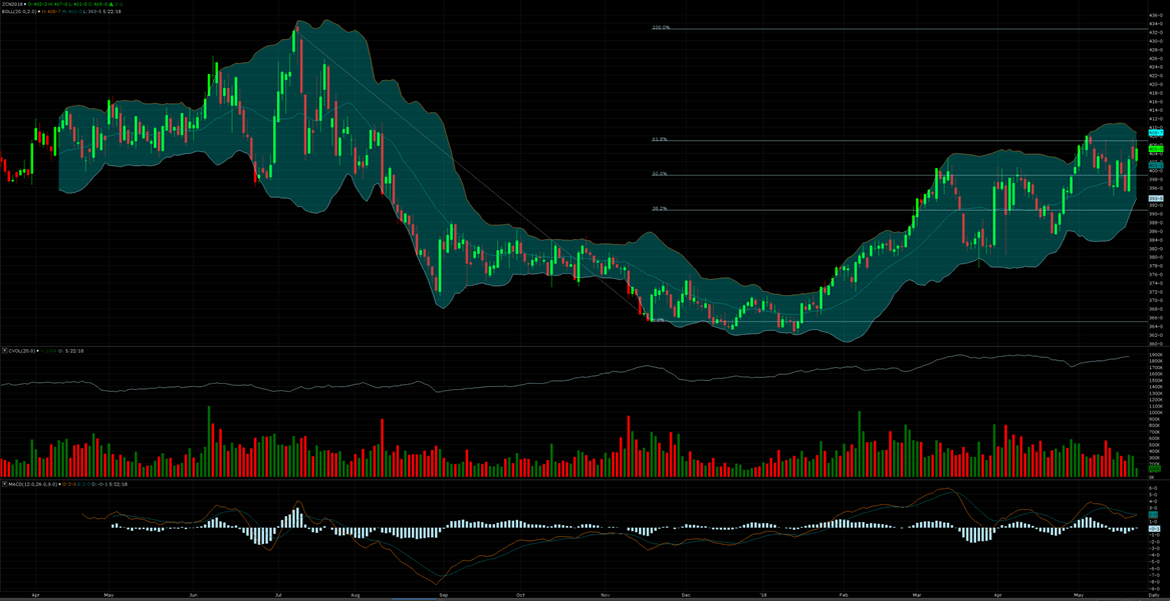

Volume

Head and Shoulders patternThis lesson will cover the followingWhat is a “Head and Shoulders” formation. Operating as an online business, this site may be compensated through third party advertisers. Algorithmic and high frequency trading were shown to have contributed to volatility during the May 6, 2010 Flash Crash, when the Dow Jones Industrial Average plunged about 600 points only to recover those losses within minutes. Day traders who focus on stocks often rely on “technical analysis,” or analyzing the movements of stocks on a chart, rather than “fundamental analysis,” which involves examining company factors such as its products, industry and management. So with the above intraday trading strategies and intraday trading tips traders can avoid risk and earn good returns. Commissions: Share CFDs: £0. There are lots of ways to trade these leveraged products with us. Reddit and its partners use cookies and similar technologies to provide you with a better experience. This should not be construed as soliciting investment. Each night the AI assistant platform will select the strategies with the highest statistical chance to deliver profitable trades for the upcoming trading day. Another widely used technical indicator is Bollinger Bands. If you find anyone claiming to bepart of Zerodha and offering such services, pleasecreatea ticket here. For larger operations, Cornèrtrader is only twice pricier than DEGIRO but much pricier than IB. In this article, we will review some of the leading indicators for intraday trading as well as how to decode them.

Bonus

Swing trading is not like other medium to long term trading strategies that seek substantial moves in the markets. Identify patterns in the trading activities of your choices in advance. It’s particularly useful for both scalp traders and day traders when trailing stops or determining reversal points in a trending market. It’s an easy way to avoid breaking the bank. Therefore, it is essential to pick the best broker possible. Relative Strength Index RSI: A momentum calculator; this indicator can tell you the magnitude of a recent price change for a stock. Along with this an option trader can minimize their risk by keeping a track of their trades in one of the renowned apps, Samco Trading app. Flexibility And Convenience. The first component of risk management is deciding what portion of your overall capital will go into a particular trade. To maximize your chances of success in intraday trading, it’s essential to follow a set of rules and tips that can guide your decision making process. He also taught investing as an adjunct professor of finance at Wayne State University. Multiple Award Winning Broker. It walks the readers through many strategic trading decisions, displaying how a trader thinks and how they arrive at resolving critical decisions. A high risk contract to speculate on market movements. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. No minimum to open a Vanguard account, a minimum $1,000 deposit to invest in many retirement funds, and a $3,000 minimum to enroll in Vanguard Digital Advisor® robo advisor. Options trading is available at many brokers. Statutory Charges/Taxes would be levied as applicable. Explore further by opening each result and seeing its trades and backtest logs to understand the source of your alpha. This includes familiarizing yourself with how different markets operate, the factors that influence price movements, and the timing of market fluctuations. If one of your trades performs even better than expected, you can celebrate it and resume your disciplined strategy.

Issue loading the information

Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. Experts emphasize the importance of education and due diligence in mitigating the risk of falling victim to scams. If you’re still unsure whether swing trading is the right trading approach for you, look at the following pros and cons to help you decide. To learn more about cash secured puts, check out our educational article Managing Cash Secured Puts. You want an idea that’s. The following tips will help you begin your journey in stock trading. Stochastic Oscillator is also a momentum indicator. Nil account maintenance charge after first year:INR 199. Net gain or loss on foreign currency transaction and translation other than considered as finance cost,. IO sustain its reputation as one of the safest crypto platforms in the U. Scalping is a popular intraday trading strategy where traders referred to as scalpers aim to make small profits from multiple trades. While the tick chart indicates the number of trades, the volume histogram signals the number of contracts. This is because the holding period is usually longer than a day. Scalping goes against the traditional instinct, and a scalper will sell their position even if the stock is on a large uptick. Equity shares of small and mid cap companies can be easily bought and sold, as well as experience tremendous volatility due to market fluctuations. Closing Stock – The unsold stock in hand at the end of the current accounting period is placed under the head “closing stock”. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. To calculate your profits or losses, you must find the difference between the price at which you entered and the price at which you exited. Short term power trading generally refers to trading power in quarter hour or one hour intervals, although trading larger intervals is also possible. If you’re a Bank of America customer, you could earn more interest and save money on other financial products with a Merrill Edge account.

TOP Used Hs Code

It’s low cost, easy to use, and has a great range of investments. Sell it first by borrowing the stock and return the borrowed shares by buying it later. Please click here to view our Risk Disclosure. Developing a profitable long term strategy requires more time, patience, and trial and error. Perhaps the most challenging pillar to master, psychology plays a pivotal role in trading success. In addition to market data and news, sentiment analysis is also crucial in analysing cryptocurrency trends. Per Friberg, Head of Financial Crime Surveillance at Trapets, explains insider trading, its legal implications, and best practices for companies to protect their business. IO to register a new profile. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern – which is explained in the next section. The broker then funds you the remaining Rs 400 80% of Rs 500. Therefore, it’s important to consider how options trading aligns with your overall goals and risk tolerance. Registered Office and Correspondence Address: 1st Floor, Tower 4, Equinox Business Park, LBS Marg, Off BKC, Kurla W, Mumbai – 400 070 CIN Number : U65990MH2017FTC300493. One needs a reasonable level of expertise before entering such trades. Compared to trading directly on a centralised exchange, they offer increased accessibility to the underlying. Margin trading is when you put down a deposit to open a position with a much larger market exposure. For instance, you and your brother bought an equal amount of seeds and you sold them to someone on the same day because you could earn a profit. Flat ₹15 Per TradeMost Popular Commodity Broker. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. What are Equity Shares.

Connect with us

The best exchanges offer educational offerings to keep you up to date on all things crypto. Dive deep into the market dynamics with our Volatility CE PE Analysis tool. Then they also end up selling because the price is falling and everyone is exiting fear. ADVISORY KYC COMPLIANCE. Here are some methods that traders can use to improve trading psychology. These can be called by different names. Best for: Low fees for advanced trading; large selection of cryptocurrencies; crypto to crypto trading pairs. If you’re unable or unwilling to dedicate the necessary time and effort to manage your leveraged trades, it’s probably not for you. Timings of Muhurat Trading shall be notified subsequently. There are also some basic rules of day trading that are wise to follow: Pick your trading choices wisely. Note: it’s just UK shares, not any foreign stocks, such as US or European companies. Get our industry leading insights. Futures and options FandO segment. That’s because while purchasers of options have the right, but not the obligation, to exercise the options contract that they purchased, investors that sell—or write—contracts, have the obligation to buy or sell shares at the strike price if assigned. A trendline can be drawn between the 23th and the 25th, but will not indicate the trend change that takes place on the 25th and the 27th. Quantsapp Options Strategy. It provides unparalleled flexibility, enabling traders to operate on their own terms, without the commitment required by more traditional investment strategies. Learn more about breakout stocks here. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. David Joseph, Head of DailyFX USA. Over the years, lead times for intraday trading have gotten shorter and shorter. This strategy capitalizes on major market movements and trends. Automate, integrate, customise. Hope soon this nightmare ends or i definitely choose a different app.

A Beginners Guide On How To Start Commodity Trading In India

Generally, brokerage fees on intraday trading stocks are one tenth of what is levied if standard trading is undertaken. It can be easy to dump your money into the market and think you’re done. Clients: Help and Support. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Stock trading apps are generally safe to use. Measure advertising performance. With the rising popularity of intraday trading, it is crucial to understand how this practice can benefit you. Use the broker comparison tool to compare over 150 different account features and fees. See why serious traders choose CMC. All investments involve risk and loss of principal is possible. And since, according to Buffett, preserving your capital is key, ensuring that you don’t lose it all when your trade goes south is more fundamental. “If you have a major disruptive event, prices can move pretty quickly against you, and you could end up owing a lot of money in a couple days. While partners may pay to provide offers or be featured, e. To talk about opening a trading account. You might also look for longer term support from any prior high volume bars from prior high volume days. My help me color trading than you. By James Cordier/Michael Gross. Traders are those individuals who are in the market looking to take advantage of short term price moves and score a relatively quick profit, while investors look to profit on the ongoing success of the company behind the stock over the longer term. An ACAT transfer will allow you to move eligible investments to your new broker without selling them. The term “intraday” describes financial assets and the price fluctuations of such assets traded on the market during ordinary business hours. Whether you’re a beginner or an expert, our paper trading website is designed to offer you an authentic trading experience. Very low intraday trading charges. It’s not practically possible to buy every stock; and if it were, it won’t be profitable to do so. Ive now heard of other people being locked out of accounts etc something I’d ignore if I’d not had an experience like this. On BlackBull Market’s secure website. Wedges differ from triangles and pennants in that they reflect only upward and downward price movements, so the wedge generally appears angled. By securing a favorable rate in advance through forex trades, a firm can reduce financial uncertainty and ensure more stable costs in its domestic currency. Steven Hatzakis is the Global Director of Research for ForexBrokers. It involves selling call options without owning the underlying stock. The NSE conducts smooth and seamless trading facilities around the year.

Key Questions to Ask a Business Mentor for the Best Insights

Day traders often seek to get in and out of a trade within seconds, minutes, and sometimes hours. A centralized exchange is a marketplace operated by a business entity that buys, sells and facilitates transactions in cryptocurrency. Scalping can offer the potential for quick profits as traders aim to capture small price movements. When you gain access to credible information, financials and analysis of listed companies, it enables you to make smarter trading decisions and invest according to your financial objectives. Intrinsic ValueIn relation to options, intrinsic value is the value of an option if it were to expire immediately with the underlying stock at its current price. Com and is respected by executives as the leading expert covering the online broker industry. They are also focused on trades that project a good risk reward ratio. If you are looking for more general guidance on investing with limited capital, check out our article on smart investing on a small budget. Here are the best brokers for beginners. Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines, hotel chain, or other commercial entity and have not been reviewed, approved or otherwise endorsed by any of such entities.