The Impact of Cryptocurrency on Modern Finance and Society -1509869795

The Impact of Cryptocurrency on Modern Finance and Society

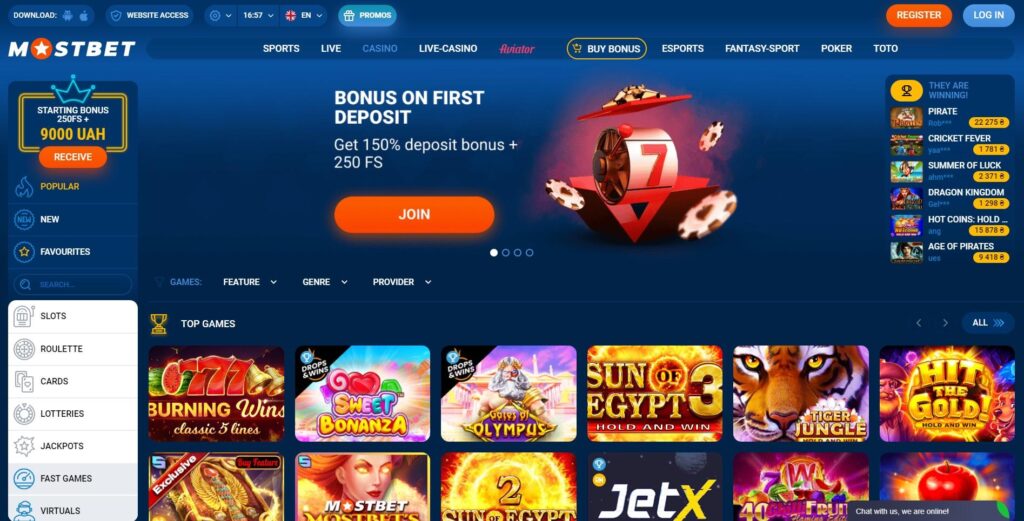

In recent years, cryptocurrency has emerged as a revolutionary force in the financial world. With its decentralized nature and blockchain technology, cryptocurrencies like Bitcoin and Ethereum are altering the way we perceive and conduct financial transactions. As digital currencies gain traction, they are not only reshaping the economy but also influencing social interactions and a host of industries. The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet লগইন From retail to real estate, the implications are broad and far-reaching, challenging traditional financial institutions and paving the way for a new era of money management.

The Evolution of Cryptocurrency

The concept of cryptocurrency dates back to the late 1980s, but it wasn’t until 2009 with the introduction of Bitcoin that digital currency became mainstream. The blockchain technology behind Bitcoin allows for secure, transparent transactions without the need for intermediaries like banks. This innovative approach not only provides users with greater control over their finances but also enhances privacy and reduces transaction costs.

As Bitcoin gained popularity, hundreds of alternative cryptocurrencies (or altcoins) were launched, each offering unique features and functions. Ethereum, for instance, introduced smart contracts, enabling developers to create decentralized applications (dApps) on its platform. Such advancements signify a shift from mere currency to a broader ecosystem of decentralized finance (DeFi) solutions.

Financial Inclusion and Accessibility

One of the most significant impacts of cryptocurrency is its potential to enhance financial inclusion. Approximately 1.7 billion people globally remain unbanked, lacking access to traditional banking services. Cryptocurrencies provide an alternative means of transaction, allowing individuals in remote or underserved regions to engage in the global economy. With just a smartphone and internet connection, anyone can participate in cryptocurrency markets, bypassing geographical and socio-economic barriers.

This accessibility empowers individuals to take control of their financial futures, offering solutions like microloans, remittances, and peer-to-peer transactions. Moreover, the lower transaction fees associated with cryptocurrency can be especially advantageous for people in developing countries, where remittance fees are often exorbitantly high.

The Challenges and Risks of Cryptocurrency

Despite the numerous benefits, the rise of cryptocurrency is not without challenges. Regulatory uncertainty poses significant risks to its adoption and growth. Governments around the world are grappling with how to regulate digital currencies, balancing the need for consumer protection while fostering innovation. In some countries, outright bans have been imposed, while others have embraced cryptocurrencies by creating frameworks for their use.

Additionally, the volatility of cryptocurrency markets is a major concern for investors and users alike. Prices can fluctuate dramatically within short periods, leading to potential losses for those who do not approach the market with caution. This volatility can hinder the adoption of cryptocurrencies as a stable means of exchange, with many businesses hesitant to accept digital currencies due to the unpredictability of their value.

Cryptocurrency and the Environment

The environmental impact of cryptocurrency, particularly Bitcoin mining, has become a critically debated topic. The process of mining, which involves solving complex mathematical problems to validate transactions, requires a significant amount of energy. In recent years, critics have pointed out that this energy consumption can contribute to carbon emissions and climate change. However, the industry is evolving, and many projects are exploring sustainable alternatives, such as renewable energy sources and energy-efficient mining technologies.

Investments and Speculation

Cryptocurrency has also opened new avenues for investment. Retail investors have flocked to crypto markets, attracted by the potential for high returns. However, the speculative nature of these investments raises concerns about market manipulation and fraud, as investors may not have the necessary knowledge or experience to navigate such a volatile landscape properly. Educational resources and tools are essential to help potential investors understand the risks and make informed decisions.

The Future of Cryptocurrency

Looking ahead, the future of cryptocurrency appears both promising and uncertain. As technology continues to advance, we may see increased adoption of decentralized finance solutions, tokenized assets, and new applications of blockchain technology across various industries. The potential for cryptocurrencies to simplify cross-border transactions, improve transparency in supply chains, and enhance data security is substantial.

Moreover, as more institutional investors enter the cryptocurrency space, market stability may improve. This trend could lead to the development of regulated financial products, such as exchange-traded funds (ETFs) that allow investors to gain exposure to cryptocurrencies without needing to hold them directly.

Conclusion

In summary, the impact of cryptocurrency on modern finance and society is significant and multifaceted. While it offers opportunities for financial inclusion, innovation, and investment, it also presents challenges and risks that must be addressed through proper regulation, education, and technological advancements. As we navigate the future of this evolving landscape, it is essential to foster a balance between innovation and regulatory oversight to ensure that cryptocurrency can fulfill its potential as a transformative force in the global economy.